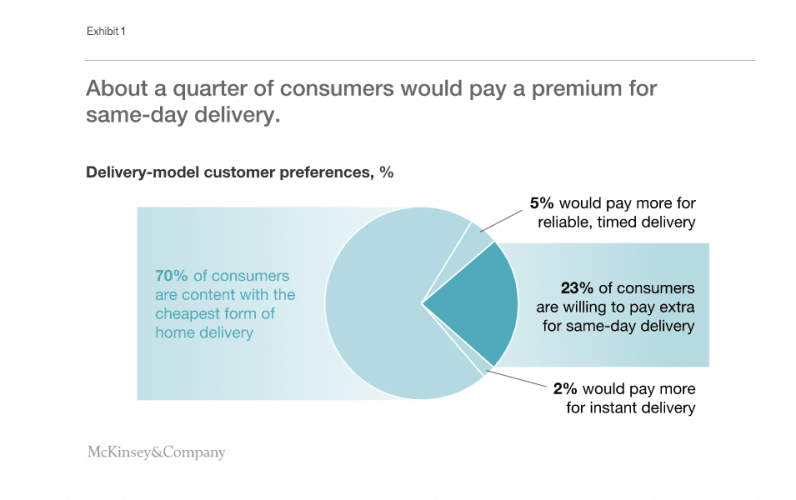

When it comes to consumer shipping, McKinsey reports that 25 percent of all consumers would pay a premium for same-day or instant delivery made possible by autonomous tech. However, this figure is likely to grow, given that 30 percent of younger consumers are willing to pay more for the same shipping options. As industry use cases continue to expand, many have come to define the ecosystem as the autonomous “last-mile.” But what exactly does this mean? In the context of consumer parcels, the last-mile refers to the final step in a physical item’s journey from supplier to end consumer. For instance, it can apply to a FedEx order traveling from a local distribution center to your front door using an aerial drone. The term can also represent the short trip your pizza takes from restaurant to kitchen table using an autonomous ground vehicle (AGV). Credit: Parcel Delivery - The Future of Last-MileHowever, the trend towards autonomous technologies is not limited to consumer parcel deliveries. Taking a broader perspective, the term “last-mile” can also apply to the movement of people and industrial goods between their point of origin and final destination. For example, a passenger that commutes to and from work using a self-driving vehicle, or a trucking company that ships goods across the country without the need for human operators. Regardless of the specific application, companies continue to explore autonomous technology in hopes of lowering costs and delivering on shifting consumer preferences. As these motives and the robust growth of e-commerce continues to drive industry expansion, large companies and various startups have begun to highlight last-mile offerings as a critical differentiator. This trend is likely to continue as organizations compete for potentially lucrative market share. However, determining how and where this is happening requires a more in-depth look. Here’s an overview of the field to give you a better understanding of the different applications of autonomous technology and the investment environment shaping this emerging movement.

The autonomous last-mile ecosystem

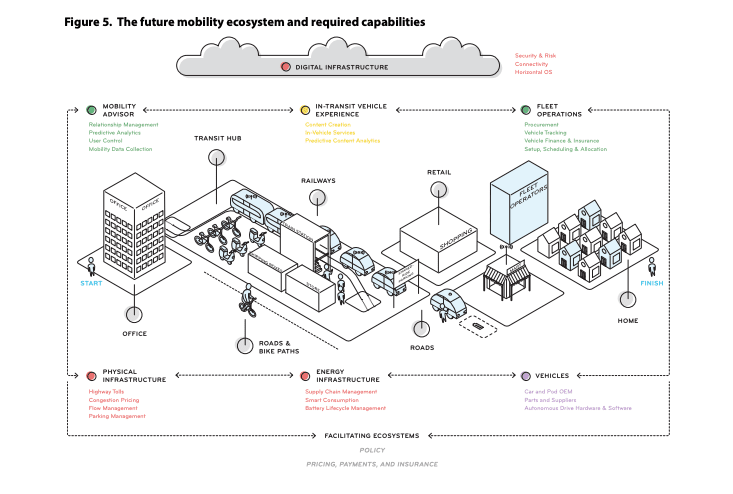

The last-mile ecosystem is diverse, encompassing several use cases across many industries. As a result of this broad reach, the economic, ecological, and financial upsides of autonomization are astonishing on a local scale and unimaginable on a global scale. However, to reach their full potential, autonomous technologies require an extensive, interconnected network of digital infrastructure. Although the path towards this reality remains unclear, individual market segments have already begun to generate impressive results. Credit: The Future of Mobility: What’s Next?

Autonomous vehicles

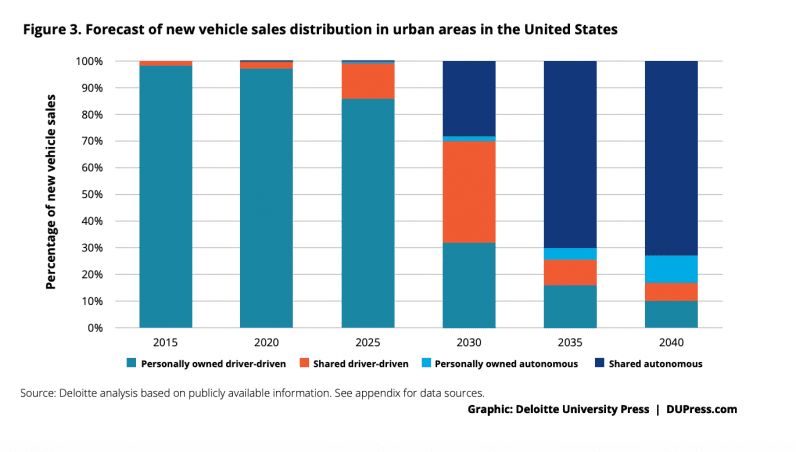

According to PitchBook, the autonomous vehicle market captured $10.3 billion worldwide in venture capital financing across 146 deals in 2018. This year, the momentum appears to have slowed slightly, with investors funneling $3.2 billion into 64 deals so far. However, looking to the future, Deloitte analysts expect over 70 percent of new vehicles to be shared autonomous by 2040. Based on these figures, growth in this market segment is likely to accelerate in coming years. Credit: The Future of Mobility - What’s Next?

Autonomous delivery

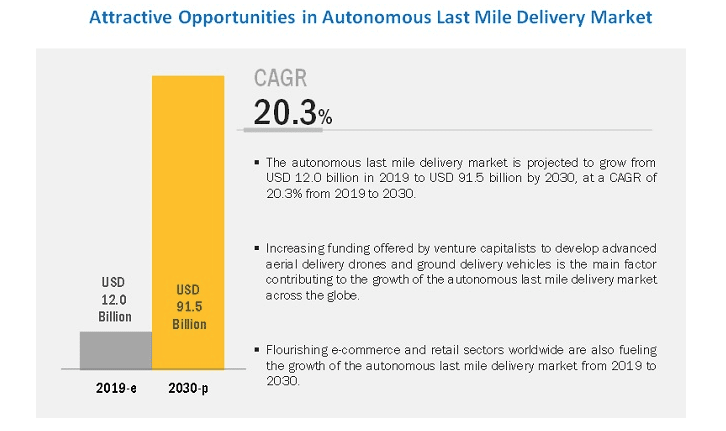

According to a recent report from MarketsandMarkets, the last-mile delivery market will generate approximately $12 billion in 2019 and is forecast to hit $91.5 billion by 2030. These estimates point to a compounded annual growth rate (CAGR) of 20.3 percent from 2019 to 2030. Consumer demand for shorter delivery times is leading to the development of aerial delivery drones and ground delivery vehicles for the autonomous last-mile shipping of packages. Although these applications offer many benefits, future flying drone regulations are likely to restrain the growth of this market. Credit: Autonomous Last-Mile Delivery Market by Platform

Autonomous industrial applications

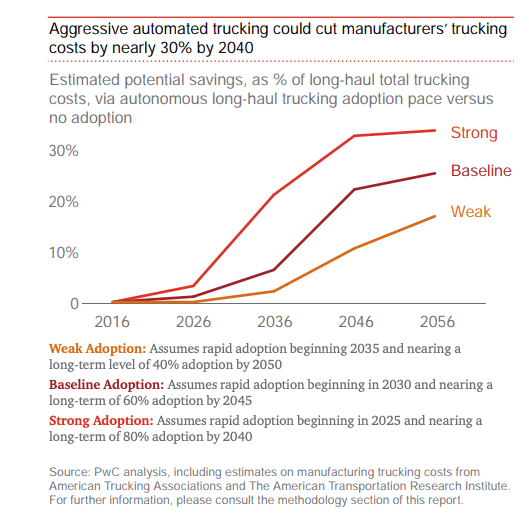

According to a report from PwC, nearly 70 percent of freight is transported by truck at some point in the US intermodal supply chain. This figure represents 10 billion tons of goods traveling in human-operated industrial vehicles. However, as autonomous technologies continue to evolve, existing supply chains will inevitably evolve. This transformation will be driven primarily by the large portion of short-haul routes in the US. In 2015, about half of transported goods were moved fewer than 100 miles from origin to destination, while only 7 percent were moved more than 1,000 miles. Because autonomous delivery tech is well-suited to shorter distances, existing market conditions are likely to support further adoption. According to PwC, trucking cost savings of 30 percent are possible by 2056 if adoption rates remain high. Credit: Industrial Mobility - How Autonomous Vehicles Can Change Manufacturing But who exactly is investing in the autonomous last-mile? Across the industry, capital is entering through the use of various funding mechanisms.

Startup acquisitions

As companies move to leverage their strengths and seek out the talents of others, acquisitions have become increasingly common. In 2016, premier transportation and logistics provider Schnieder simultaneously announced the acquisition of Watkins & Shepard and Lodeso. These acquisitions allow Schnieder to bring together industry-leading final-mile delivery, claims-free handling, and an innovative tech platform. By combining these companies, Schneider has effectively grown its Final Mile+™ service, which provides customized, white-glove service to home, commercial, and retail clientele. Just last month, DoorDash also announced the acquisition of Scotty Labs, a startup developing autonomous and remote-controlled vehicle technology. Although it remains uncertain what projects Scotty will work on under its new parent company, the company’s AI focus provides a few hints. According to Scotty CEO, Tobenna Arodiogbu, the company is “focused intensely on developing core infrastructure and algorithms to ensure the safe deployment of autonomous vehicles.”

Venture capital funds

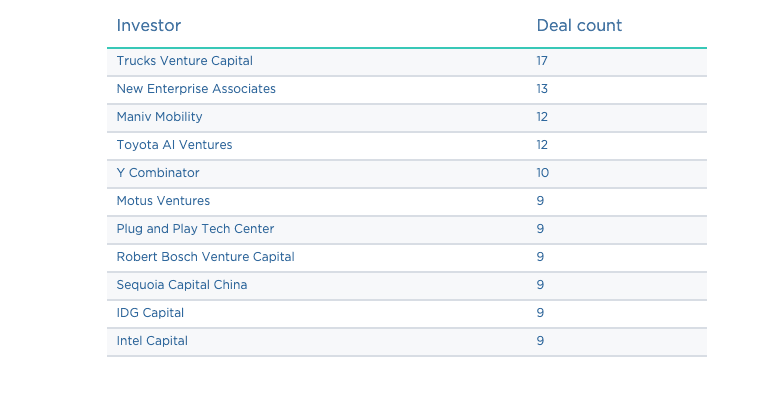

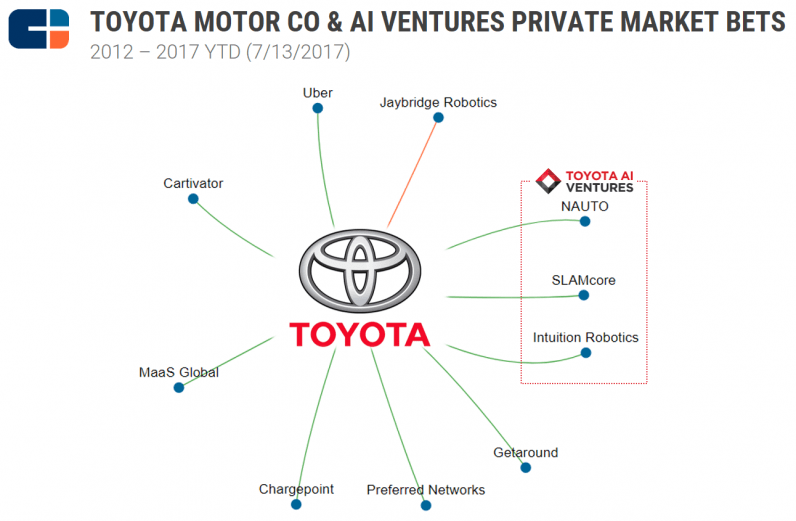

The global autonomous vehicle market has also raised billions of dollars from venture capital funding between 2018 and 2019. However, several other industry verticals continue to attract substantial investment. Toyota AI Ventures is another venture capital firm investing heavily in this space. The investment arm of the Japanese automaker has made 12 deals in the autonomous tech vertical since 2010 and raised $100 million for its second fund (Fund II) in May of this year. This recent funding has brought the firm’s total assets under management to more than $200 million. Credit: CB Insights

Internal investments

Several companies exploring the autonomous ecosystem have also begun developing and investing in their projects. Typically, these companies fall in the parcel delivery segment. Between June 1 and November 30 of this year, FedEx will pilot last-mile delivery services in five markets. According to company executives, each market will handle their pilots, and none will exactly resemble a nationwide rollout, should one occur.

Navigating the autonomous last-mile

The autonomous tech ecosystem consists of several segments that span many use cases. From parcel delivery to autonomous passenger vehicles and industrial applications, the industry is vast and complex. To cut costs and deliver on consumer expectations, those exploring the last-mile space must continue to assess market conditions to achieve ongoing success. As robust capital inflows continue, the autonomous last-mile movement shows immense promise for future applications.