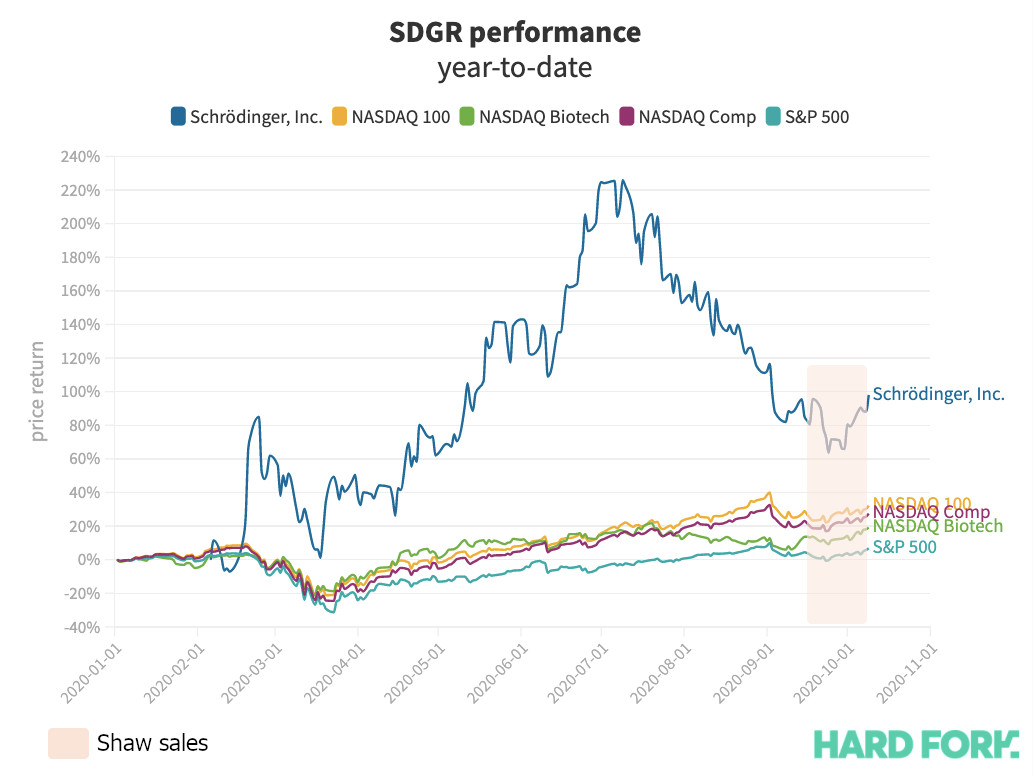

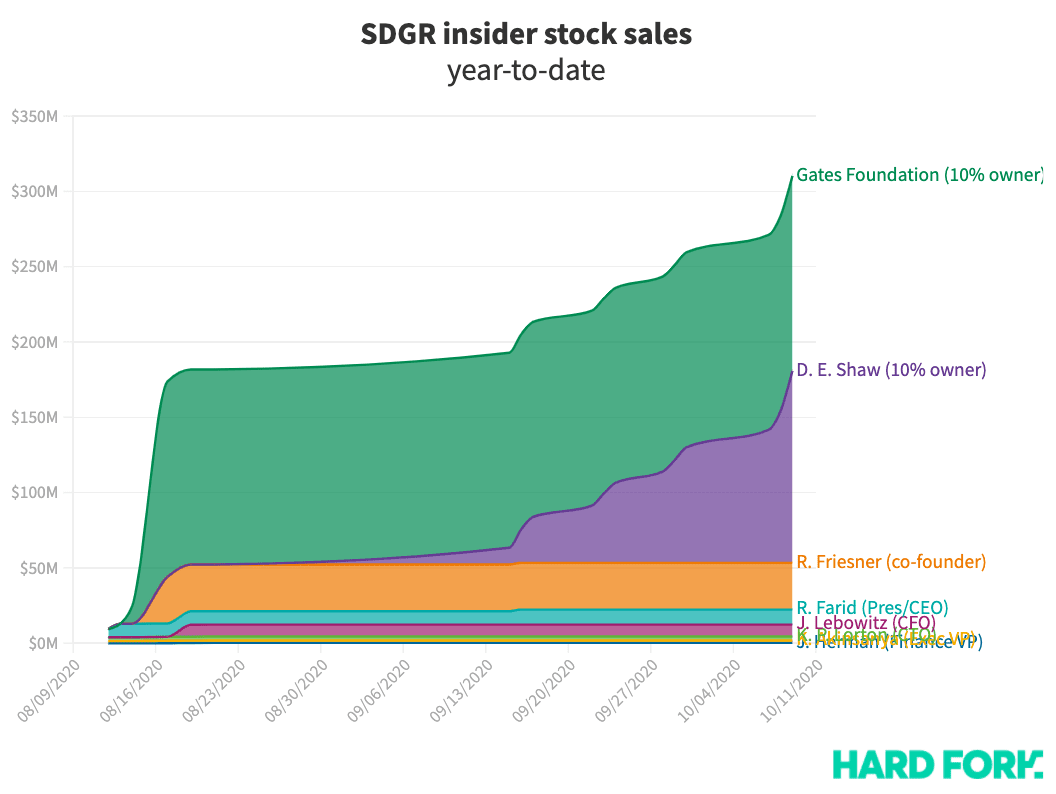

David Shaw, the secretive 69-year-old investing legend, has now sold more than $127 million worth of SDGR stock in the past month alone. In that time, SDGR’s share price hovered between 217% and 233% above its February issue price of $17 — impressive, but well below SDGR’s $93 record high in July. These are noticeably Shaw’s first stock sales of any kind all year, according to finance portal Finviz. The moves were made in line with a pre-set trading plan lodged with the SEC in August. Shaw has been long on SDGR for a serious amount of time; Crunchbase dates Shaw’s initial $31 million investment right back to 2001. SDGR’s website even features that moment prominently in its promotional timeline. He retains around $800 million in SDGR stock.

David Shaw is a stock market legend

Indeed, the mostly-retired Shaw is famous among Wall Street insiders. His fund DE Shaw & Co. was one of the industry’s first ever “quant” shops, which use powerful computer algorithms to identify lucrative short-term trading signals. The Financial Times noted DE Shaw & Co’s Composite fund has posted just one annual loss since 2001 (in 2008), and returned double-digit profits in seven of the past 10 years. This year, however, the outlook is looking a little grim. But Shaw isn’t the only prominent billionaire balls-deep in SDGR. Microsoft co-founder Bill Gates is there too, having bought nearly $100 million worth of SDGR stock during its IPO. Gates also invested in the company’s $85 million venture capital raise last year. The Bill and Melinda Gates Foundation currently holds around $320 million in SDGR shares.In fact, Shaw and Gates own around 40% of all SDGR stock. This gives the two billionaires huge sway at the company, a situation short-selling crew Citron Research deemed even more extreme than the Musk-heavy power structure at Tesla. “Beyond the ‘dollars invested,’ what is significant about the investment of those two men who are known for their intellectual prowess is the validation that Schrödinger is on the forefront of using artificial intelligence and computational chemistry to streamline the drug discovery process,” wrote Citron analysts in February. “David Shaw upon his retirement from DE Shaw has dedicated his life to computational biochemistry; Schrodinger is the result of much of this work.” [Read: Tech’s market debutantes overshadowed by Gates-backed pharma stock] As for how much SDGR stock Gates has dumped in 2020: $129.5 million, a couple of million dollars more than Shaw, and the two billionaires are together responsible for more than 80% of all SDGR insider sales year-to-date.